Mason Nystrom

Crypto AI Agents: The First-Class Citizens of Onchain Economies

Bots are becoming the first-class citizens of the crypto economy.

You need not look very far to see evidence of this trend. Searchers deploy bots, like Jaredfromsubway.eth, to take advantage of a human user’s desire for convenience by front-running their DEX trades. Banana Gun and Maestro, which allow human users to make bot-enabled trades from the convenience of Telegram, are consistently some of the most frequent gas guzzlers on Ethereum. And now, on new ephemeral social apps like Friendtech, bots are entering the fray after the app finds initial human user adoption, and can inadvertently further bootstrap the speculative flywheel.

All this to say that bots, whether profit-driven (e.g. MEV bots) or consumer-driven (e.g. Telegram botkits), are increasingly often the prioritized users on blockchains.

While bots in crypto so far have been fairly rudimentary, bots outside of crypto have started to evolve into robust AI agents thanks to the rise in large language models (LLMs), with the end goal of autonomously handling complex tasks and making their own well-informed decisions.

Building these AI agents on cryptonative rails yields several important enhancements:

- Native payment rails: AI agents can exist outside of crypto, but if we want AI agents to perform complex actions they’ll need access to capital. Crypto rails present a meaningful improvement for giving AI agents access to capital over having them obtain access to bank accounts or payment processors (e.g. Stripe), or deal with the vast majority of other inefficiencies that exist in our offchain world.

- AI agent wallet ownership: AI agents connected to wallets will have the ability to own assets (e.g. NFTs, yield, etc.), giving agents the digital property rights that are inherent to all crypto assets. This is especially important for agent-to-agent transactions.

- Verifiable, deterministic actions: AI agents will be most effective when actions are provable (where they can ensure that some action was completed). Onchain transactions are deterministic in nature—they either happened or didn’t—which means AI agents will be able to more accurately complete tasks onchain than offchain.

Of course, there are limitations to onchain AI agents.

One limitation is that AI agents will need to perform logic offchain to be performant. This means onchain AI agents will host their logic/computation offchain to optimize efficiency, but agent decisions will be executed onchain, allowing for verifiable actions. Importantly, AI agents can also use zkML providers like Modulus to ensure their offchain data inputs are verified.

Another key limitation of AI agents is that they are only as useful as the tools they are given. For example, if you ask an agent to give a summary of a real-time news event, the agent needs to have a web scraper in its toolkit to comb the internet to perform the given task. Do you need the agent to save the response as a PDF? Add a filesystem to the toolkit. Want the agent to copy trade your favorite Crypto Twitter influencer? The agent needs access to a wallet and key signing permissions over said wallet.

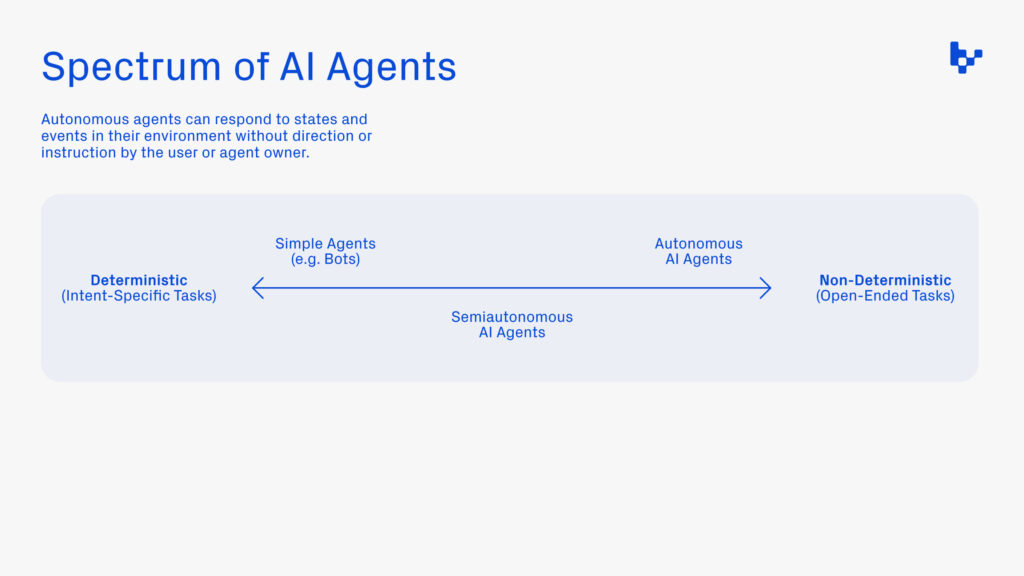

Looking at the current landscape on the spectrum of deterministic to non-deterministic, most crypto AI agents perform deterministic tasks. That is to say, humans program the parameters of the tasks and how the task (e.g. a token swap) is accomplished.

Crypto AI agents have evolved from the early days of keeper bots—which are still utilized across DeFi and oracle apps—to today’s more sophisticated agents that leverage LLMs, including autonomous artists like Botto; AI agents that can bank themselves using Syndicate’s transaction cloud; and early AI agent service marketplaces like Autonolas.

There are already a variety of exciting applications at the bleeding edge:

- AI agent-enabled “smart wallets”: Dawn leverages DawnAI to provide an AI agent that can assist users with sending transactions, executing tradings, and other real-time onchain insights (e.g. trending NFTs).

- Crypto gaming agents: Parallel Alpha’s newest game Colony aims to create AI characters that can own a wallet and transact with each other.

- Enhanced toolkits for AI agents: AI agents are only as good as their toolkits, and interacting with blockchains is currently a nascent area. Crypto AI agents need wallets, ways to fund them, permissioning capabilities, integrated AI models, and the ability to interact with other agents. More concretely, Gnosis has showcased what this early infra looks like with its AI mechs, which wrap AI scripts with a smart contract such that anyone—including another bot—can call the smart contract to perform the agent action (e.g. make a bet on a prediction market) while also being able to pay the agent.

- Augmented AI traders: DeFi super apps that provide elevated actions for traders and speculators, including: DCA into a position if conditions are met; executing trades when gas prices drop below a certain price; monitoring new meme token contracts; and determining order routing without the user having to know where to onboard, etc.

- Enabling the long tail of AI agents: While large applications like ChatGPT are good for some general chat purposes, AI agents will need to be fine-tuned for numerous industries, subjects, and niches. Marketplaces like Bittensor create the incentives for “miners” to train models for specific tasks (e.g. image generation, pre-training, predictive modeling) around target industries (e.g. crypto, biotech, academia). While Bittensor is nascent, developers are already using it to build applications/agents on top of the long tail of open-source LLMs.

- NPC consumer app agents: Non-playable characters are common in games like MMORPGs, but less common in multiplayer consumer apps. However, the financialized nature of crypto consumer apps makes AI agents excellent participants to introduce new types of game mechanics. Open AI infrastructure company Ritual recently released Frenrug, an LLM-based agent operating inside of Friend.tech that will execute transactions (buy or sell keys) based on user messages. Friend.tech users can attempt to convince the agent to buy their keys, sell others’ keys, or attempt to get the Frenrug agent to use its funds in other creative ways.

As more applications and protocols leverage AI agents, humans will use them as a conduit for accessing the crypto economy. And while AI agents look like toys today, in the future they will augment daily consumer experiences, become key stakeholders in protocols, and create entire economies between themselves.

AI agents are in their infancy, but these first-class citizens of onchain economies have only just begun to showcase their potential. If you’re testing the boundaries of how AI agents augment onchain experiences, please reach out: [email protected].

Special thanks to Tom Waite and Sami Kassab for conversations and feedback on the ideas within the essay. Thanks to Dan Roberts for edits and making the essay sound buttery.

+++

This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Variant. While taken from sources believed to be reliable, Variant has not independently verified such information. Variant makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post reflects the current opinions of the authors and is not made on behalf of Variant or its Clients and does not necessarily reflect the opinions of Variant, its General Partners, its affiliates, advisors or individuals associated with Variant. The opinions reflected herein are subject to change without being updated.

Variant is an investor in Botto, Modulus, and Syndicate.