Jack Gorman

New Signs of Life in the Ethereum & L2 NFT Ecosystem

Onchain data shows new entrants and new use cases for NFTs

To the outside world, NFTs are dead.

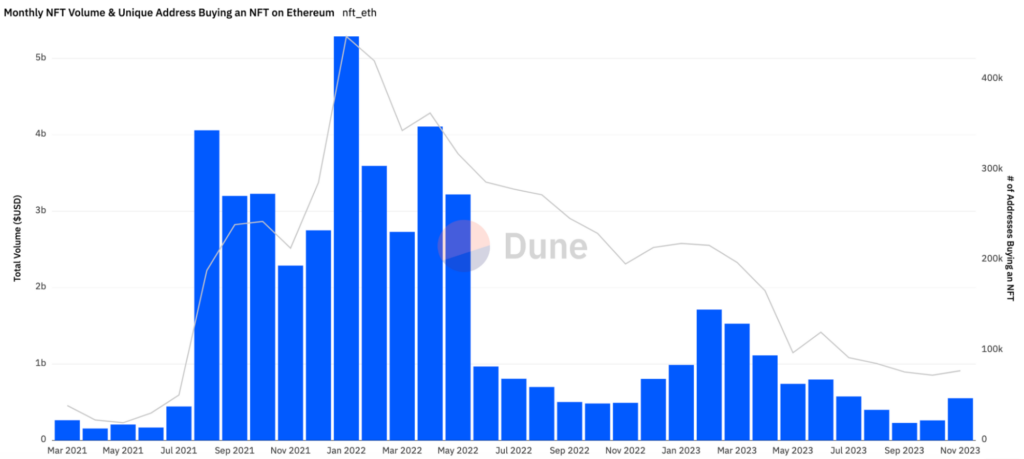

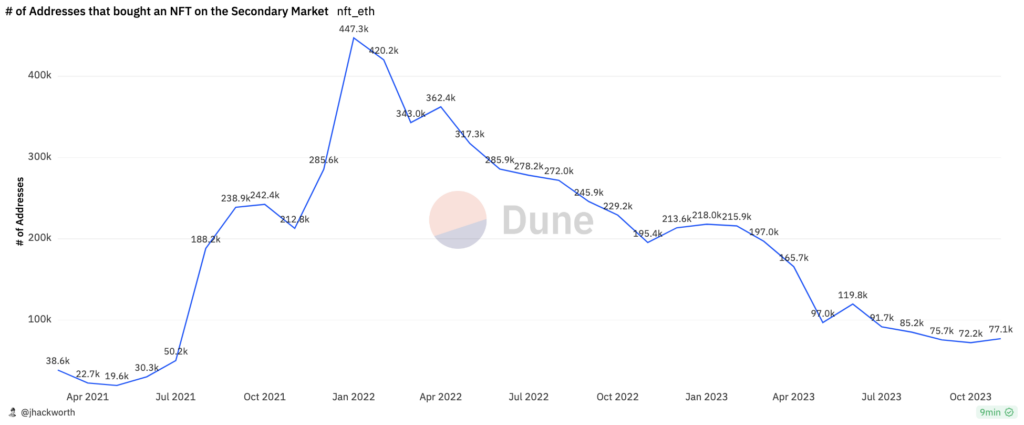

When you look at secondary-market sales data—the most commonly cited metric—it’s hard to argue. From the NFT market peak in January 2022 through November 2023, secondary trading volume on Ethereum has fallen by ~90%, and the number of distinct addresses buying an NFT on secondary platforms has fallen by ~82%. September 2023 saw the lowest NFT trading volume and number of buyers on Ethereum since June 2021.

But the secondary market (which has been picking up in recent weeks) only paints a partial picture. When you look elsewhere, there are new signs of life for NFTs.

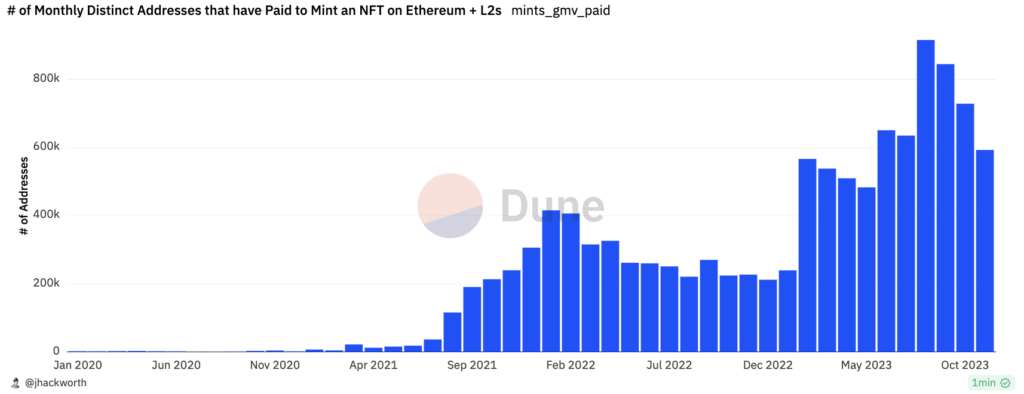

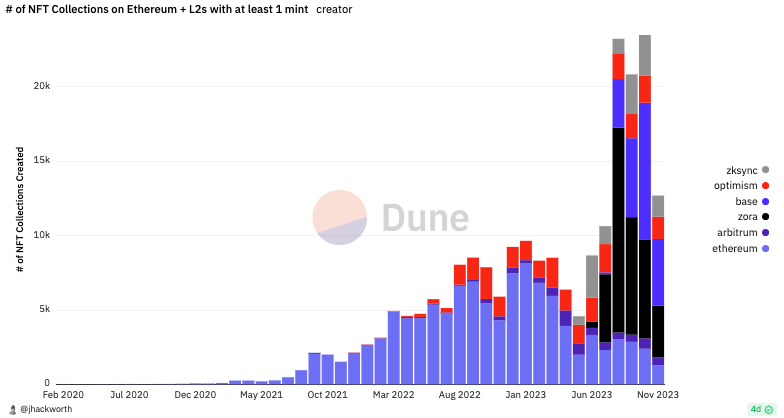

One encouraging indicator of NFT adoption is the growth in both creation and collection across Ethereum plus layer-2 chains like Base, Zora, and Optimism. For collecting, the number of distinct addresses minting paid NFTs over time has continually grown, suggesting there are new participants minting onchain.

The growth in collecting activity has been accompanied by a rise in new NFT contracts on chains like Zora and Base, driven by an array of creator tools that make it easier to create NFTs.

While there is certainly some spam and airdrop farming in these numbers, these stats should still be encouraging.

One possible explanation for the growth in distinct addresses and new contracts is a simple Occam’s Razor view: As more projects, use cases, and art are being created, more cryptonatives are engaging in NFTs. And by lowering the overall financial costs of NFTs, more non-cryptonatives will join in the coming waves.

We may also be witnessing a shift in the perception and use cases for NFTs. In the past, rarity, exclusivity, and power-user trading were defining factors of the NFT market, making it harder to onboard more users to crypto. Now, the proliferation of NFTs in various formats and use cases beyond high-end collectibles presents a new opportunity to engage users and promote widespread adoption.

Prior barriers to NFT adoption

During the last bull market, NFTs emerged as a new asset class for Ethereum. In January 2022, NFT trading volume reached $16 billion ($5.2 billion after removing wash trading1). Yet despite high volumes, only 447,260 distinct addresses actively bought NFTs on the secondary market that month. This suggests that NFT adoption overall was relatively small even at the market peak, dominated by a core group of active collectors and collections.

Why was adoption smaller than many thought? High cost, limited use cases, and speculative trading dominated by whales may have kept people away from NFTs.

Looking at the table below, you can see just how expensive it was to mint, trade, or create NFTs onchain: average NFT contract deployment cost $812 in 2021 and minting cost $115.

High gas costs acted as a barrier, limiting what new entrants could do with NFTs and what artists and builders could create onchain.

This hindered early NFT adoption, favoring higher-priced assets such as art or PFPs that had the potential for value appreciation to justify the onchain costs.

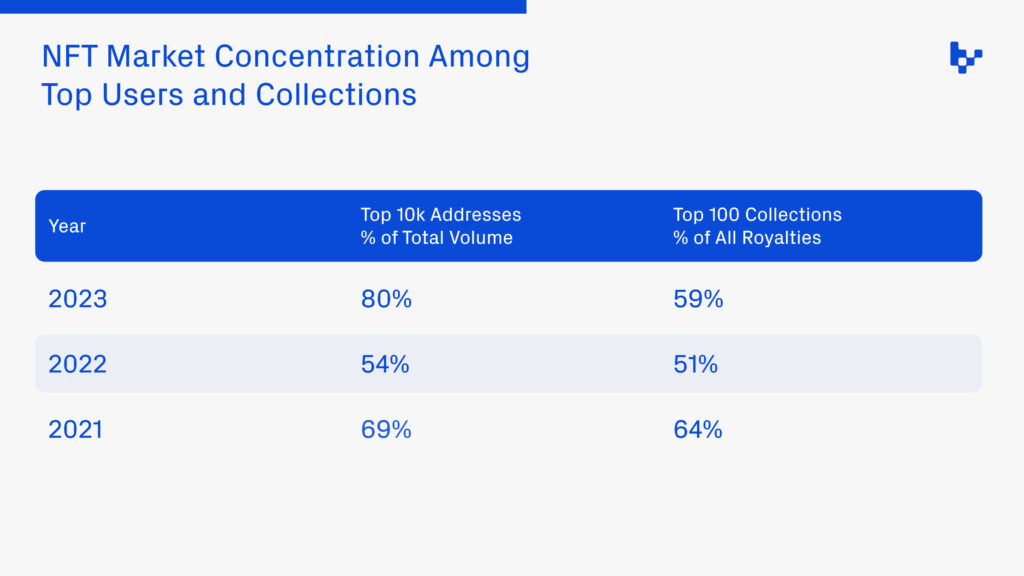

Breaking this down even further shows that NFT market activity was concentrated among a few collections and traders. In 2021, just 10,000 different addresses (0.73% of all buyers) accounted for 69% of the total volume, and the top 100 collections represented 64% of all royalty projects.

Of course, these barriers—high costs and limited use cases—aren’t specific to NFT adoption.

New technologies often follow a similar pattern of adoption, with early adopters typically being affluent individuals, niche groups, and speculators. In the early days of the internet, usage was limited due to challenges in building and interacting on the web. Like with NFTs, speculative investments poured into dot-com companies, driving up valuations to unsustainable levels until the bubble burst. But the internet’s underlying potential remained intact, and as infrastructure improved and user experiences became more engaging, the internet transformed society.

I believe this same shift is beginning right now with NFTs. Focus is moving away from investments and luxury goods toward a technology that revolutionizes digital ownership for the masses. As the saying goes, what was a luxury yesterday becomes a necessity today.

I can’t predict what will happen next with the NFT market. However, three onchain trends are showing us where the future of NFTs may be heading:

- Infrastructure and tooling have improved, lowering minting costs and increasing the potential use cases of NFTs (mints, collections, and collectors) embedded in applications

- New models of community participation—beyond just holding an NFT—provide opportunities for sustaining community engagement, such as onchain curation, governance, and protocol rewards

- New forms of NFTs beyond just PFPs and art are gaining traction, including gaming, real-world assets, and token-bound accounts

Minting costs are coming down

As any technology improves, costs decline and new segments of demand get unlocked. We are seeing this play out right now in NFTs as layer 2s, improved tooling, and better infrastructure are reducing the overall cost to mint NFTs.

The cost of minting the most recent 1 million NFT transactions on Ethereum was $2.5M, but it was just $62.92K on Base, and $75.99K on Zora2. Meanwhile, free mints are on the rise: ~62% of Ethereum & L2-based NFTs were free to mint3.

Cheap NFTs are a feature, not a bug. Lowering the cost barriers allows for more collecting, more experimentation, and more building. More affordable NFTs will also provide new use cases where NFTs are the how, not the why.

For instance, Blackbird uses NFTs to track restaurant visits as part of a loyalty program to reward diners at their favorite restaurants. This application is made possible by Base allowing the minting of NFTs for cents and improved tooling like Privy, offering a better user experience.

Many of Blackbird’s users may not even realize they are holding NFTs. Moving forward, I expect more applications to utilize NFTs under the hood to engage with consumers in innovative ways.

Empowering the community

While the previous bull market was focused mainly on flipping NFTs, we are now seeing a return to emphasizing holder communities.

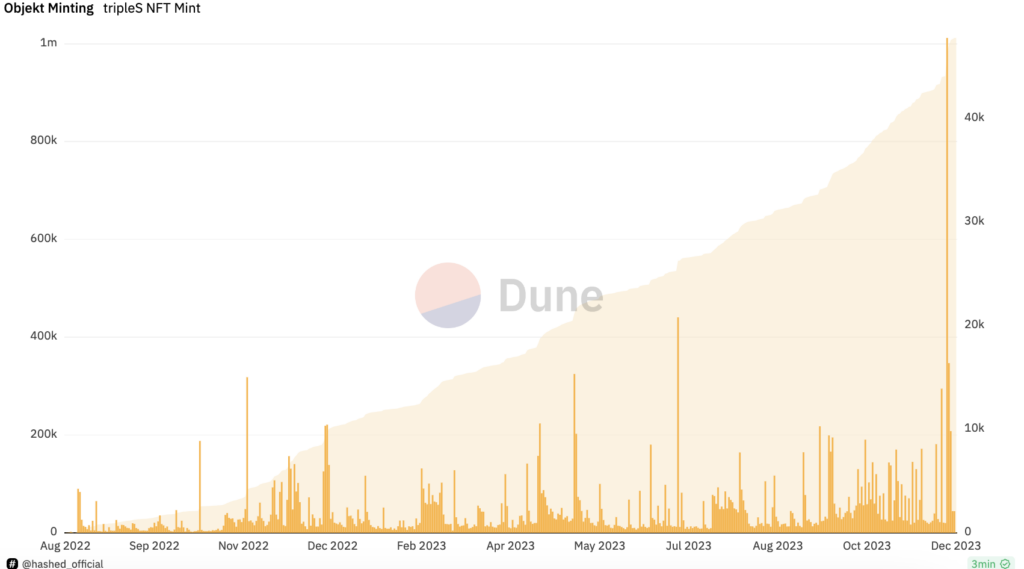

Some, like Botto and Basepaint, are collaborating and voting to guide which themes or artworks should be chosen. Others are providing a new spin on NFT governance. For example, K-pop group TripleS uses NFTs known as Objekts as a way for fans to vote on the future of the group (e.g. picking the name of the song or selecting a subunit of the 24-girl group to record their own songs). So far, results have been positive, with over 1 million mints and 87,000 collectors as well as millions of views on Spotify and YouTube.

Source: Hashed

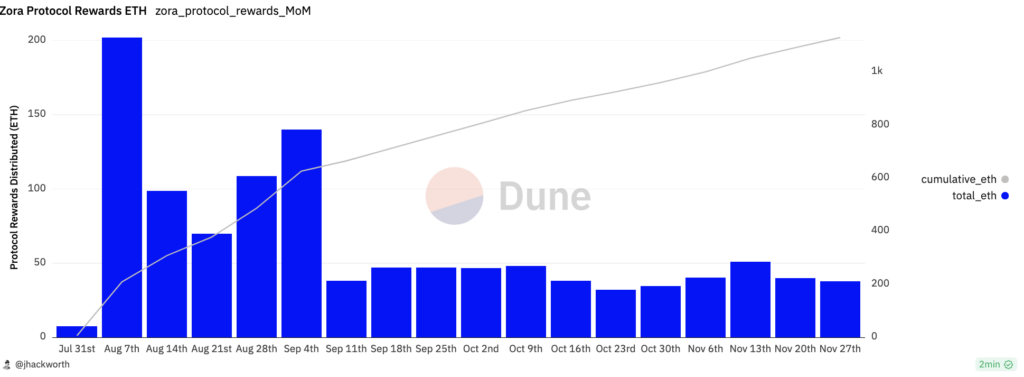

Initiatives such as Zora’s protocol rewards have shown ways to incentivize users to create and participate onchain. The program has had early success, with over 1,130 ETH (roughly $2.5M at the time of writing) distributed to thousands of collectors, creators, and builders on the network.

What makes many of these initiatives so exciting is that they allow community members to take a more active role in the community while growing the network.

NFTs are taking new forms

The dominant collection type in the last market was the PFP, a public flex that you owned a rare or high-price image. While some of the most notable collections will likely always have value, NFTs will likely take various formats such as gaming-related, music, or even tokenized versions of real-world assets. Courtyard has recently begun tokenizing Pokémon cards, which had over 9.7B card sales transactions in 2022, unlocking a more liquid market for the asset.

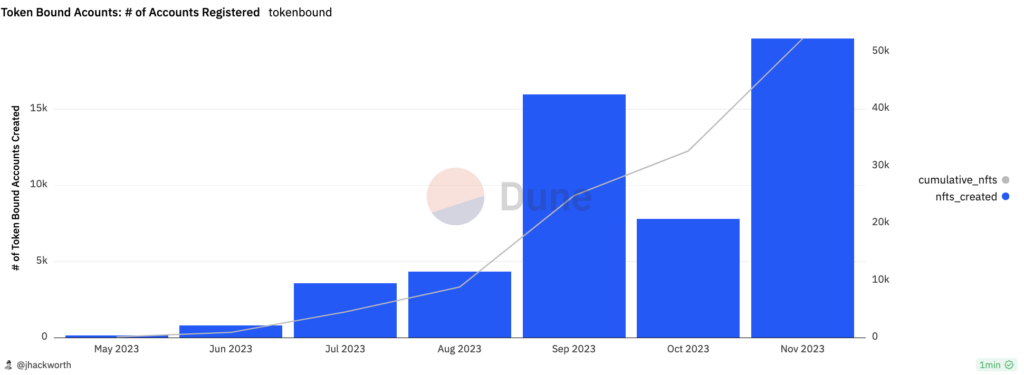

Even beyond just the ERC-721 and ERC-1151, new standards are emerging, such as ERC-6551, or Non-Fungible Token Bound Accounts. Token-bound accounts transform NFTs into self-contained wallets capable of holding assets. While still small at only ~52,000 total NFTs, the number of token-bound accounts has been growing at a compound monthly growth rate of ~90% since June4.

Token-bound accounts provide more than just NFT ownership; they enable the creation of a profile with an embedded social graph and inventory system. This concept, already used by Lens for social media profiles, extends to future possibilities where the account becomes the avatar in a video game or a specific Bored Ape becomes a personality with its own following.

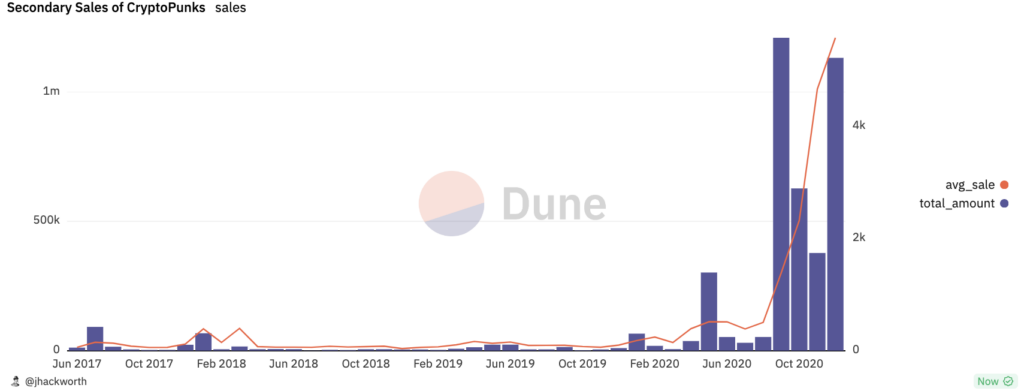

We’re still very much in the early stages of NFTs as an asset class, and it’s extremely difficult to predict how everything will play out. After all, CryptoPunks were originally free mint, with very little activity for years after their June 2021 debut until Punk prices exploded during the NFT boom. In 2017, very few people could have foreseen that by 2021, some Punks would be trading hands for $10 to $20 million.

I am excited to see the continued evolution of NFTs. There is a ton of experimentation happening in the space, which is encouraging. As use cases for NFTs multiply, NFT minting will become more commonplace. Internet users may own hundreds if not thousands of NFTs across their wallets for use in a variety of applications.

If you, like us at Variant, are excited to help grow the pie of NFTs in existence, you can collect and mint this post as an NFT on Mirror.

[3] Free NFTs

[4] Growth Rate

+++

This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Variant. While taken from sources believed to be reliable, Variant has not independently verified such information. Variant makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post reflects the current opinions of the authors and is not made on behalf of Variant or its Clients and does not necessarily reflect the opinions of Variant, its General Partners, its affiliates, advisors or individuals associated with Variant. The opinions reflected herein are subject to change without being updated.

Variant is an investor in Blackbird, Botto, Zora, and Lens.