Alana Levin

Reflections on the State of Crypto: Q2 2024

Where we are today and where we’re headed

Every six months or so, I write an internal reflection on the state of crypto and where I think we’re headed. I decided it worthwhile to publish my most recent one for public consumption.

The commentary is broken up into three sections: what’s working, other things that have happened (or are happening), and what new things I’m looking forward to. I try to ground much of the analysis in data, but admittedly let my opinion slip through in brief pockets. Hopefully it’s an interesting read. If the reception is positive or the feedback is productive, I’ll consider sharing more of these internal reflections in the future.

Working Today

The good news is that there are a number of things working, and working in serious ways. The growth of these – many of which I’d call “big ideas,” in that they can meaningfully change how the status quo operates – should create new opportunities as second-order effects of their success.

For clarity, I use the term “what’s working” to refer to projects or trends that show signs of sustainable product-market fit, are expanding the size of the crypto market, or both.

So, what seems to be working or growing today? I’ve selected a (non-exhaustive) list of 10 things I think are demonstrating notable signs of “working”:

- Stablecoins

- Bitcoin as an alternative asset

- Farcaster, an early but growing social network

- Asset creation

- Community-created and trained AI models

- Solana

- Ethereum

- Zora

- Coinbase

- Onchain exchanges

- Bonus: Blackbird

#1: Stablecoins

Onchain stablecoin supplies have seen ~$25B in net supply inflows YTD. Overall, inflows have been positive since November 2023. Permissionless, global access to the US dollar continues to enjoy strong product market fit.

#2: Bitcoin as an alternative asset

Just under a dozen Bitcoin spot ETFs were approved in January. As of early June, over $80B worth of value sits in Bitcoin spot ETFs. (I follow Blockworks’ and The Block’s trackers for data).

Gold seems a strong analog for understanding institutional allocation into Bitcoin: regardless of whether you think the asset represents an inflation hedge, it is an alternative to traditional equities that enjoys some level of social consensus around its value. One could argue that Bitcoin is much better than gold – in that it can be more easily transferred, there is a knowable supply cap, and the asset is seeing adoption on both some corporations’ and countries’ balance sheets – and therefore may exceed gold’s market cap someday.

In the private markets, Q1 was characterized by an influx of projects looking to extend the utility of Bitcoin. This ranged from (many) Bitcoin smart contract layers, to onchain lending protocols, to exploring ways Bitcoin’s economic security budget can be leveraged to help secure other chains. My guess it that any fruits of these developments will probably be born in H2 of this year.

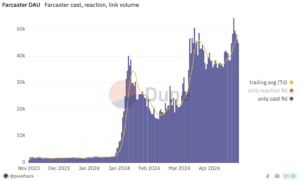

#3: Farcaster

Farcaster, a social network built on open protocol rails, started to enjoy meaningful growth.

The inflection point occurred in late January, around the launch of frames. Frames are mini-app-like components that people can share and engage with directly in the Farcaster clients’ social feeds.

#4: Asset creation

The number of new tokens created continues to go up. One way to track this trend is by looking at the number of new tokens appearing on DEXes (decentralized exchanges). Activity appears to be largely driven by asset creation on Base and Solana.

On Solana in particular, the past few weeks have seen over 10k new tokens created each day.

Many of these new assets are in the form of memecoins (tokenized memes). I would not describe myself as active in the memecoin space, but I do recognize that there is a very real and engaged group of users who have demonstrated an eagerness to participate.

Notably, the emergence of these new assets has led to some unanticipated but productive byproducts in the broader ecosystem. For instance, we’re seeing greater experimentation with new tools, like Solana’s token extensions. A token called $BERN leveraged Solana’s new token extensions to innovate on token economics: if someone sold their tokens, 5% of that trade was destroyed (as a reallocation mechanism to remaining holders). $BERN’s popularity became a forcing function for wallets to adopt the token extension standards – which are productive in that they can enable complex payment splits, confidential transfers, and more. Without $BERN, who knows how long adoption of token extensions would have taken.

Overall, my main takeaway is that asset creation seems like a trend with tailwinds. Regardless of how you feel about these assets, owning the issuance and exchange continue to be two great places to sit in the flow of value.

#5: Community-created and trained AI models

It seems clear we’re headed for a world of abundant access to LLMs, with low cost of creation and many options to choose from. In that world, where does value accrue?

I hold the view that value accrues to scarce resources. So in a world with abundant compute, abundant content, and abundant tooling, the question becomes: what’s scarce? One answer is taste and attention. The hard part is that taste and attention are fairly intangible resources. Even when we can measure them (e.g. “screen time” acts as a measure of attention), it’s hard to put a dollar value on that metric.

We’re starting to see pockets of where crypto rails help by tightly coupling financial rails with taste- and attention-based activities. Specifically, community-created and trained AI models with some sort of productive output – such as a good or service (e.g. artwork, a film, IP, etc.) that can be sold or licensed – offer the ability to reward participants. For models with subjective outputs, the community participants act as tastemakers by training the model on their cultural preferences. There’s a strong incentive to select for good taste: the more tasteful the output, the more it should sell for.

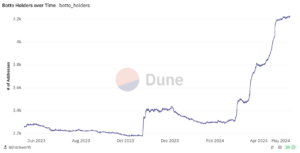

We’re starting to see a few of these emerge in a way that is real and working. Botto is my favorite example. It’s an autonomous artist, where $BOTTO token holders have the ability to help train the model each week.

Botto’s art is good and getting better, proxied by the increasing prices of the Botto pieces sold at its weekly auction. In tandem, the network of owner-participants has also continued to grow:

I think we’ll start to see more community-created and trained AI models, especially as the known and working instances (like Botto) continue to grow in prominence.

Some businesses are tackling the challenge of attribution top-down via litigation, data licensing agreements, or both. If we assume that the status quo represents <1% of the model-based output that will exist, say, five years from now, it’s clear there’s room for other attempts at tackling attribution and distributing value to contributions. Crypto rails offer a uniquely valuable solution. Crypto strengthens both economic and creative attribution. Meaningfully, it also allows for anyone, anywhere to participate.

In an old blog, Chris Dixon muses:

“[There is a] famous remark: ‘The future is already here – it’s just not very evenly distributed.’ An obvious follow up question is: if the future is already here, where can I find it?”

Community-created and trained models are one area where we have some small but growing projects that very much point the way to a much bigger future.

#6: Solana

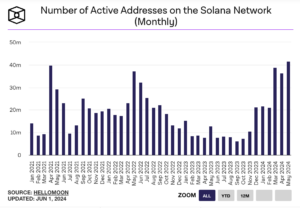

Daily active addresses interacting with Solana are 2-3x higher than this time last year, and roughly in line with the highest periods of activity in the 2021 cycle. The number of monthly active addresses is up 3-4x in the same timeframe, hitting a new all-time high in May 2024:

The network has also started generating meaningful fee revenue, beginning to prove the hypothesis that Solana’s low fees will make up for it in greater user activity / volume.

The takeaway: Solana’s trajectory is indicative of something that is working, and working in a meaningful way. Solana is here to stay.

#7: Ethereum

The Ethereum ecosystem has also enjoyed notable progress. There are two ways to frame this growth: by focusing on Ethereum itself, and by looking at the Ethereum system of chains (i.e. inclusive of Ethereum roadmaps) as a whole.

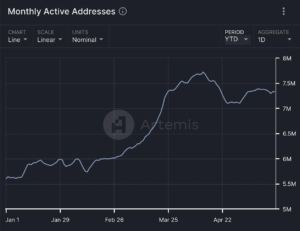

Ethereum itself has seen notable growth in monthly active addresses. The trailing 30d average has increased by ~30% YTD and is just ~10% off its 2021 peak.

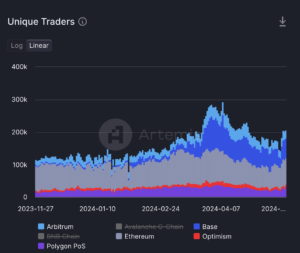

Looking at the Ethereum ecosystem more holistically also shows significant growth signs. I’ve aggregated the daily active addresses from five of the top Ethereum-based chains – Ethereum, Arbitrum, Base, Optimism, and Polygon – in the chart below. The five were in part selected for their rich ecosystems of apps and developers building on top.

The takeaway: Ethereum has been and continues to be one of the most important ecosystems in crypto.

#8: Zora

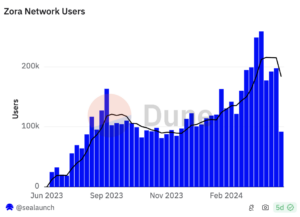

Zora Chain (also known as Zora Network) has been live for approximately one year. Over that time, the network has continued to find its footing. Weekly active users are up ~60% YTD and recently surpassed a new high of 250k. The chain has also enjoyed a ~34% profit margin, meaning that Zora keeps about a third of the ETH that users spend on transaction fees.

Zora Chain helps validate the notion that applications with sufficient distribution can start to vertically integrate with other parts of the stack (e.g. blockspace) to unlock more attractive economics.

#9: Coinbase

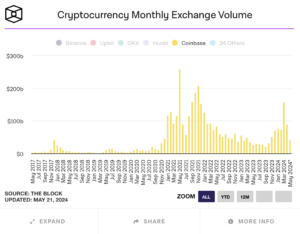

Coinbase has also had a strong start to the year. It was listed as the custodian for 8 of the 11 Bitcoin Spot ETFs. The exchange business has also continued to make strides – hitting a high of $157B in exchange volume, a number it hadn’t achieved since November 2021.

Transaction fees still account for a large portion of Coinbase’s revenue. In Q1, the platform generated over $1B in trading fees (approximately two-thirds of its quarterly revenue).

But just as notably, Coinbase has continued to diversify its revenue streams beyond transaction-based fees. Blockchain rewards revenue and custodial fee revenue both doubled from a year prior. Stablecoin revenue neared $200M, with the growth in the circulating supply of USDC offsetting (slightly) lower interest rates. Coinbase One, Coinbase’s membership suite, surpassed 400k subscribers. Base, Coinbase’s layer-2 protocol, is generating millions in onchain fees every month.

Coinbase’s success is demonstrating what (until recently) many have only hypothesized to be true: there are many meaningful new business models to be built around crypto primitives.

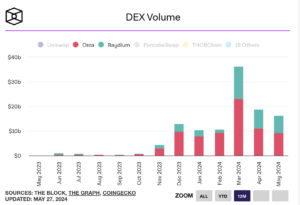

#10: Onchain exchanges

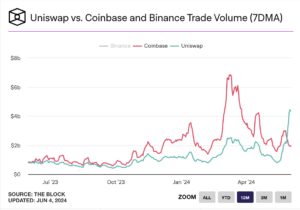

Across major Ethereum chains, the number of unique Uniswap users (traders) approximately doubled from six months ago.

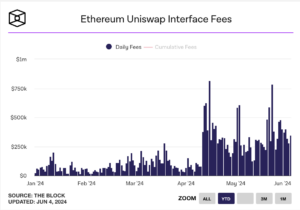

One definition of a successful protocol is one in which successful businesses can be built on top. We’re seeing that with onchain exchanges, exemplified by Uniswap Labs’ growth in revenue generated by its interface:

The 7-day moving average of volumes facilitated by Uniswap (the protocol) also recently surpassed that of Coinbase:

Importantly, it’s not just in Ethereum where we’re seeing growth of onchain exchanges. Within Solana, Orca and Raydium – two of the leading DEXes – have also seen notable growth:

That onchain protocols are facilitating multiple tens (if not hundreds) of billions in value exchanged each month is no joke. Both the protocols and interfaces represent very real, revenue-generating projects. In cases where there are centralized institutions (e.g. interface businesses), my hope is that we see some of these profits reinvested toward improving security, robustness, and user experiences.

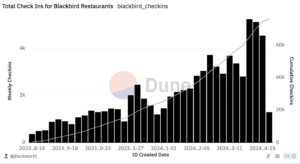

#11 (Bonus): Blackbird

Blackbird is a loyalty and rewards program for the restaurant industry, built with crypto rails under the hood. When users check in at a Blackbird-connected restaurant, the app mints an NFT for them – a digital artifact of their visit, and a data point for restaurants in the network to learn more about their customers’ dining habits. Today, Blackbird exists primarily in New York City.

Blackbird has continued to grow daily check-ins among its user base.

Personally, Blackbird has nudged my own dining habits: whereas I used to let my friends pick where we should eat, I’ve become much more active in suggesting places for us (and largely use the Blackbird app to guide where might be an interesting spot to dine).

Other Things That Happened

Other notable trends in the past two quarters include the rise of social-fi and a proliferation of new chains (mostly L2s and L3s in the Ethereum ecosystem). While I find it too early to say whether they’re definitively working yet, it is notable that these trends are meaningfully influencing what users are doing onchain and how developers are evolving their business models.

#1: The growth of social-fi apps

A number of financialized social (“social-fi”) apps have emerged. Several have generated millions in fees. Friendtech and FantasyTop are the two most popular ones I’m aware of. There are clearly users who find these apps fun and are willing to engage. It’s great that users are being provided with new things to do onchain.

I’m skeptical of the sustainability around some of these business models. Speculation alone seems an insufficient propellant for long-term success. But that’s ok. It’s possible some of these apps are only a few tweaks away from more sustainable business models. Capturing attention – even if initiated by speculation – provides an opportunity to monetize that interest in a number of other ways. That critical second step, though, is of course the hard part.

#2: A proliferation of new chain launches

We’ve also seen many new chains – particularly L2s and L3s – launch. For these chains within the Ethereum ecosystem, it seems the underlying tech is not a material point of differentiation. Rather, brand and community trump all. Base, the L2 launched by Coinbase, is probably the epitome of a strong brand. The chain has enjoyed a(n anecdotally) growing developer ecosystem, even without the direct token incentives other chains use to attract talent.

To date, we’ve seen roughly three ways that chains attempt to differentiate:

- The underlying technology. Examples would be integrated vs. modular chains, or optimistic vs. zero-knowledge rollups.

- Chain economics. Canto was the first chain in recent years (that I know of) to experiment with a redistribution of transaction fees to the developers building in the ecosystem. Blast and Berachain are now experimenting with various other types of yield generation and economic allocation. It’s not clear the extent to which these are sustainable – both in general economic considerations, and in terms of providing a long-term competitive advantage.

- Brand and community. A chain’s culture and/or reputation can serve as an attractive halo for builders: it may bolster the perception that developers will receive more help (from the community or other developers) when building in the ecosystem, it could provide reputational cover in the eyes of certain consumers (“no one gets in trouble for picking a MacBook” or something like that), and/or the values that a chain’s community espouses could simply align with a developer’s own ideology.

Mature chains have elements of all three. Take two that I highlighted above as “working”: Ethereum and Solana. Ethereum pioneered the EVM, implemented EIP-1559 (burning a portion of the transaction fees as a redistribution mechanism to ETH holders), and grew a strong developer community and ethos around its tech. Solana popularized the integrated blockchain, was the first to make low fees commercially viable, and has a community that was truly forged in fire during the 2022-2023 downturn.

My hypothesis is that the next wave of chain differentiators will stem from external integrations. Examples might include seamless access to additional sources of funds (e.g. Coinbase accounts), screens like KYC for wallets, or verification that someone is human. It’s a really broad design space and is an area I’m excited to explore more deeply.

Looking Ahead

Looking back at the past half year, my main takeaway is that we are still largely talking about the things we were talking about 6-12 months ago, but with more maturation on the “what’s working” front. As these mature, many should and will turn into platforms that create opportunities as a byproduct of their success. Growth causes growing pains, and those pains create room for third parties to provide solutions.

Anticipating growth in these major platforms can also provide a foundation for thinking about where we’re going. The things I’m paying the most attention to are new forms of distribution and new building blocks.

New Distribution and Better Building Blocks

On the distribution front, some vectors for growth I’m excited about include: Farcaster with greater scale, Telegram apps with greater wallet functionality, and interfaces like World App continuing to onboard more people (it is already at 10M)

There are also a number of new and exciting build blocks. Coinbase launched a smart wallet that lets users pay directly from a Coinbase account. Reservoir’s Relay protocol helps eliminate the user experience of bridging funds between chains, making a “one-click” checkout experience onchain finally feel possible. World ID continues to grow and will hopefully provide a way to authenticate between humans and agents. There are many more.

This may sound vague. I occasionally get frustrated when I read something that comes across more as abstract hope than reality, so I’ll attempt to avoid that here with a concrete example of what these building blocks and new distribution channels enable.

Take modern advertising, a multi-billion dollar market that touches almost every business. My guess is it’s racked with inefficiencies, despite decades’ worth of improvements in attribution and targeting. Now imagine instead what “advertisements” might look like on Farcaster:

- A company could send coupons directly into their target customers’ wallets (because every account has an associated wallet).

- The coupons might be based on some mention of a similar product in a post the consumer created, or a post that the user liked.

- The business can operate with the confidence that data will remain open and accessible forever (i.e. no concern about APIs being shut off or prices being jacked up), which allows it to then invest in refining the effectiveness of this distribution channel.

- The budget is only spent if the consumer converts to a sale (i.e. the coupon is used).

All around, it seems like a win for both businesses and consumers, uniquely enabled by open social graphs, embedded payment rails, and verifiable digital identities.

Maturing Chains Point Toward the Future

Another notable takeaway from the “what’s working” section is that there are now several credible and growing ecosystems (Ethereum, Solana, Bitcoin). The three ecosystems compete on unique differentiators, and eachs’ respective edge creates productive pressure on the others to continually improve. For instance, Solana’s success with low fees and high throughput has pushed Ethereum to continually innovate at both the base layer and with L2s. Similarly, that Ethereum has multiple clients has likely created a goalpost for Solana to achieve client diversity (e.g. with its upcoming Firedancer client). Bitcoin was the first to achieve true institutional adoption, but has started to experiment with implementing new elements of programmability (with Ordinals, Runes, and the potential OP_CAT upgrade). Broadly, I would sum this up as each ecosystem continuously trying to achieve rough feature parity with the others. Observing where each is at today – and the positive relative features demonstrated by its peers – can serve as a guidepost for where each may try to implement improvements.

This feels very positive-sum. I’m a tennis fan, so I’ll use a loose tennis analogy. Federer, Nadal, and Djokovic likely would not have achieved the same levels of athleticism had they not been competing with each other. Each pushed the others to elevate their game, and the result was truly excellent tennis. I think the same is true of what we’re seeing with different chains in crypto today. Each is making greater progress, faster, because there’s productive pressure to improve. The result is an entire industry that should hopefully be net better off.

Some New Ideas

There are also still many desirable pieces of infrastructure and applications to build. Some underexplored areas I’m interested in that hold potential:

- Different forms of credentialing. Credentials (certifications, attestations, etc.) are valuable resources to put onchain: the ability to timestamp issuance and verify the issuer both benefit from being on a public ledger. One example of such credentials might be workplace verifications – a receipt from an employer that someone worked at a company for a certain period. Within the crypto industry, I’ve seen a number of attempts at attestations. I think the key here will be identifying credentials that hold real economic value – like employment verification – and honing in on those markets.

- Price-differentiated assets (PDAs). These are goods with real economic value but a wide divergence in willingness to pay among market participants. Restaurant reservations are a good example. An article recently went viral about the underground reservation market in NYC: popular reservations are attacked by bots and resold on exclusive secondary markets for thousands of dollars. It seems to me that, if one takes the viewpoint that such financialization is inevitable, making those “assets” as transparent and accessible as possible seems like a net positive for both diners and restaurants. Restaurants could more easily check the transfer history of the reservation, while more potential consumers could participate. Tokenizing reservations could even enable some sort of programmatic price cap, or a revenue share back with the restaurant. This is just one example. There are many more markets where real assets, with fundamental economic value, are being mis- or inefficiently priced because access to the markets is opaque or limited.

- New forms of token distribution. There are many opportunities to nudge people’s existing behaviors with token rewards as a byproduct of activities they would already do anyway. Blackbird is the first and most notable example: dining out was already a widespread activity, but the presence of Blackbird rewards has likely changed where and how frequently some users choose to dine. This could be applied more broadly, in areas where people already spend time and money but have little consistency or allegiance in their consumption activities. In particular, I’d look for categories where merchants could benefit from some sort of consortium or co-op effect (in terms of greater data / insight into consumer behavior across merchants) and there is a large opportunity to improve customer loyalty (via nudge-style incentives).

Whether there are uniquely good “why nows” for these ideas is admittedly an open question. They mostly strike me as good ideas that have been good ideas for a while, but have not yet been fully explored (and thus are worthy of more shots on goal).

Concluding Thoughts

This reflection represents many, but importantly not all, of the things I think have happened in crypto recently. Some areas it doesn’t touch on – but maybe could (or should) have – include the growth in permanent storage solutions (like Arweave), the maturation of defi protocols into true financial platforms (like Morpho), and Telegram’s impressive push with TON.

For further reading, you can find many of my thoughts on my blog Back of the Envelope or on the Variant website. In particular, I’d recommend New Opportunities in the Farcaster Stack and What Onchain Apps Enable if you enjoyed this report.