Jack Gorman

Why UniswapX Will Be Additive to the Uniswap Protocol

Based on how fat-head and long-tail token trades work on DEXs, UniswapX should be net good for the Uniswap protocol.

This was first published as a Twitter thread.

At EthCC in Paris last week, Uniswap announced UniswapX, a new protocol for trading across AMMs. Our view is that UniswapX will be additive for the Uniswap protocol. Here’s why, based on a deep dive of Uniswap protocol fundamentals we did at Variant. (See our Dune dashboard here.)

One crucial fact to understand is that ~25% of volume produces the majority of fees (over the past 180 days). If you read no further, just remember this statistic.

UniswapX is a new aggregator protocol built by Uniswap Labs. In short, a new party called “fillers” (essentially searchers) is introduced to fill swappers’ orders using both onchain and offchain liquidity sources.

This might seem like a threat to the underlying AMM protocol because “fat head” assets like ETH and BTC typically have higher volumes and more efficient price discovery on offchain CEXs. If fillers route to offchain liquidity, fat-head volume in the protocol may decline.

But while fat-head liquidity could be routed to other places, we don’t believe this represents a serious threat to the Uniswap AMM. Uniswap still prices most long-tail tokens (DeFi tokens, memecoins, etc.) better than elsewhere, as it’s the primary market for many of those tokens.

So is UniswapX an existential threat to the Uniswap protocol? Probably not. This is because AMMs were never intended to compete with central limit order books (CLOBs), which are ultimately a more efficient market structure when there are significant makers and takers.

AMMs are uniquely well suited to price discovery and liquidity for long-tail tokens, more niche tokens that don’t have sufficient liquidity to efficiently trade on a CLOB. AMMs create passive liquidity, allowing a smaller number of buyers/sellers to still be able to trade.

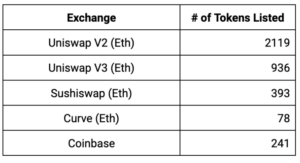

Uniswap controls the vast majority of long-tail liquidity. Based on CoinGecko data, Uniswap has the most token listings of major Ethereum trading apps.

This largely stems from the long tail of crypto being so large, and it roughly expands ~2x every major cycle.

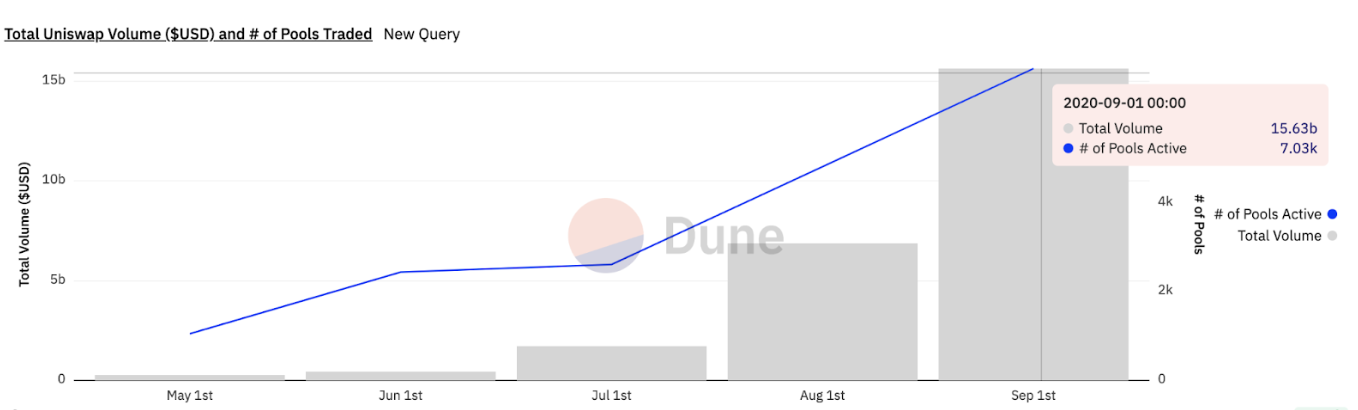

The “DeFi Summer” of 2020 provides an interesting case study, when most CEXs couldn’t list long-tail tokens because of their quantity, lack of liquidity, and other factors. Monthly volume on Uniswap roughly 10x’d from that July to September.

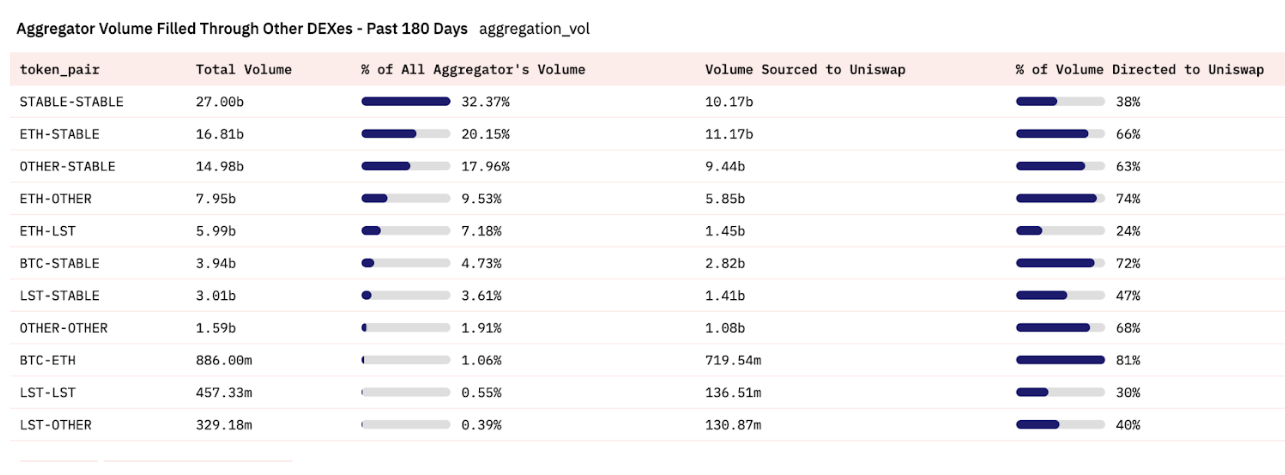

Because of its deep liquidity from billions of TVL, Uniswap prices these tokens better than other onchain liquidity sources. The query below shows what portion of aggregator trade-flow routes to Uniswap by type of token pair.

Notice how the token-pair category of ETH/“OTHER” (DeFi tokens, memecoins, etc.) has 74% of volume directed to Uniswap vs other exchanges. This suggests that Uniswap is more competitive at pricing the long tails than other DEXs.

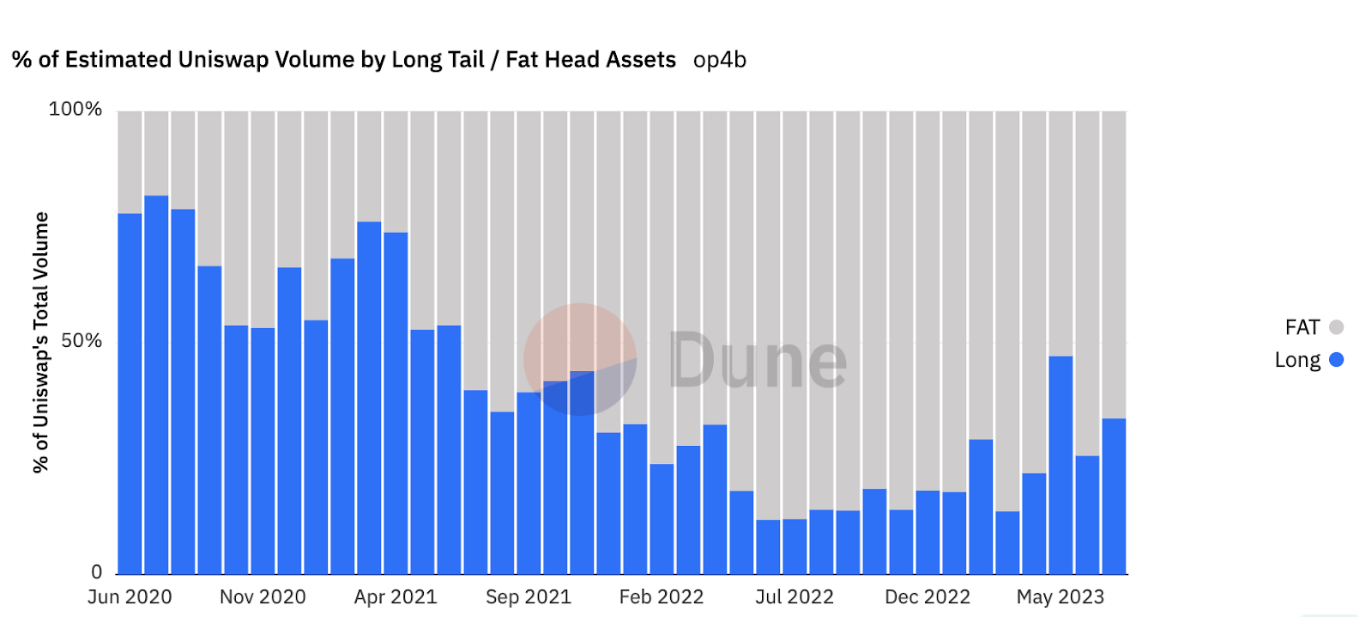

The query below shows Uniswap monthly volume since June of 2020, separated by long tail and fat head. Fat head is any major L1, L2, and stable pair. Over time, it becomes clear that more and more Uniswap volume is fat-head pairs.

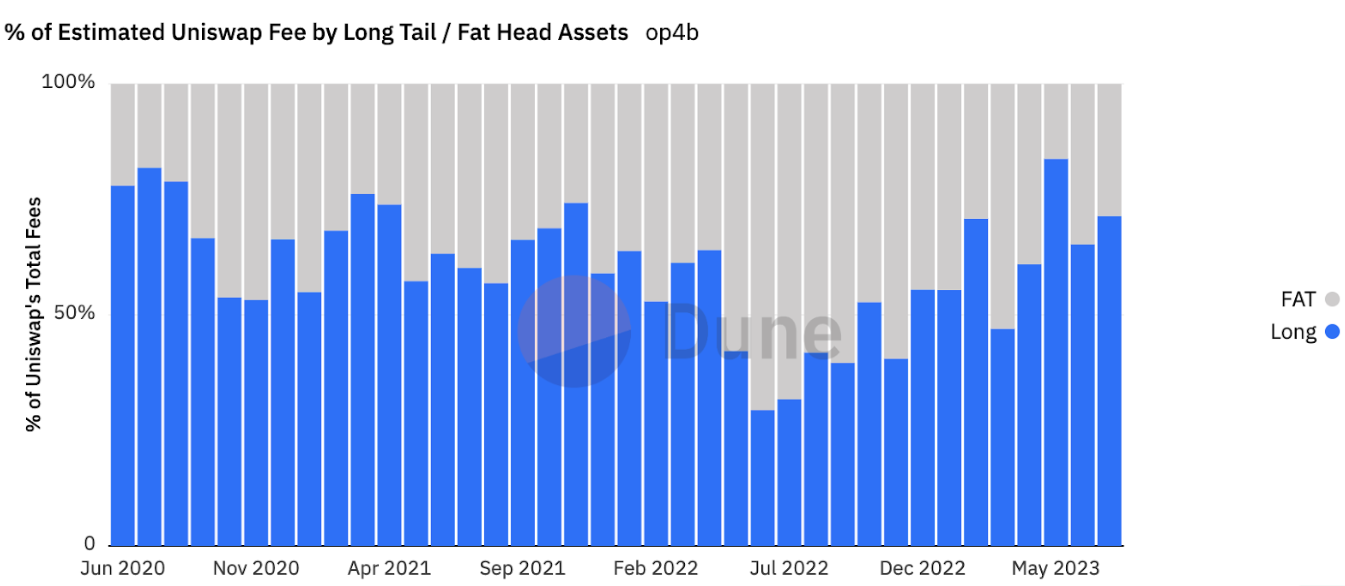

The trend in fees is quite different. Outside of a few outlier months, the vast majority of fees are generated by long-tail pairs. This is because Uniswap V3 introduced lower tiers, which compressed fees for more competitive fat-head liquidity.

One interpretation of this is that longer-tail liquidity is more valuable than fat-head liquidity, since it’s proven to be much less fee sensitive, it’s scarcer, and accessibility and convenience are often more important than price efficiency.

UniswapX ensures better pricing for fat heads, even where the AMM can’t deliver. As long as the Uniswap protocol remains the best liquidity venue for long tail, we expect the front-end interface will continue routing those trades to the protocol.

The most successful protocols have a healthy ecosystem of sustainable applications built on top. As crypto matures, protocols need to ensure they double down on the unique value proposition they bring to the end-user applications that integrate them.

Uniswap has always done this for long-tail pairs, and our view is there will be tons of them, and that is where the revenue is being generated. UniswapX helps with discovery of the long tail by attracting additional users through more efficient pricing.

+++

Variant is an investor in Uniswap. This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Variant. While taken from sources believed to be reliable, Variant has not independently verified such information. Variant makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post reflects the current opinions of the authors and is not made on behalf of Variant or its Clients and does not necessarily reflect the opinions of Variant, its General Partners, its affiliates, advisors or individuals associated with Variant. The opinions reflected herein are subject to change without being updated.